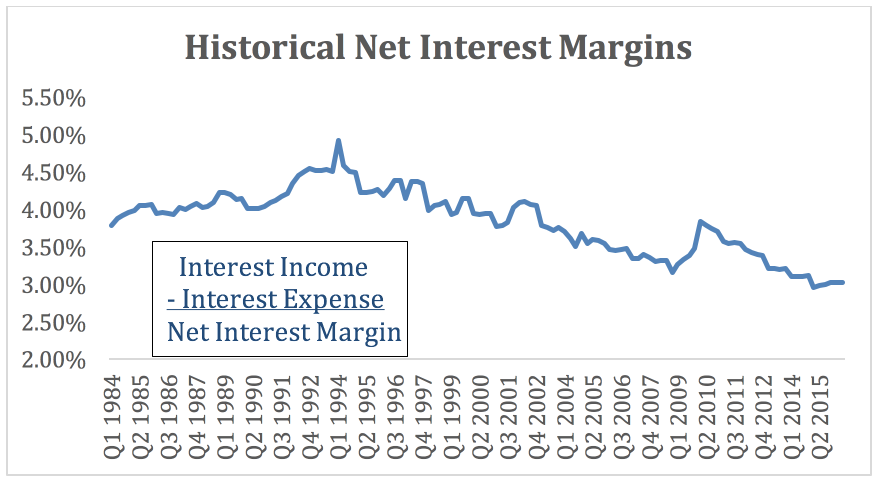

Going back to the 1980s, net interest margins (NIMs) typically hover between 3-4 percent. So what, you say? Well, the lesson to be learned here is that even as the Federal Reserve starts to raise interest rates, don’t expect much relief when it comes to your profit margins.

Source: Federal Financial Institutions Examination Council

Source: Federal Financial Institutions Examination Council

Raising Interest Rates, Lowering Loan Demand

Compounded with low NIMs is the likelihood that demand for credit products will slow as many consumers refrain from borrowing because of the prospect of higher monthly payments for autos, homes and other big ticket items. This will force many financial institutions into looking to non-interest income – aka fees – to make up for the lost revenue from depressed loan demand.

Raising Fees, Losing Account Holders

Unfortunately, consumers consider bank and credit union fees only slightly more favorably than they do root canals. In their minds, they’re paying for something the bank or credit union should provide for free — a cost of business, you might say. In fact, one of the major reasons consumers switch primary financial institutions (PFIs) is perceived unnecessary fees imposed by their PFI.

What Can Financial Institutions Do?

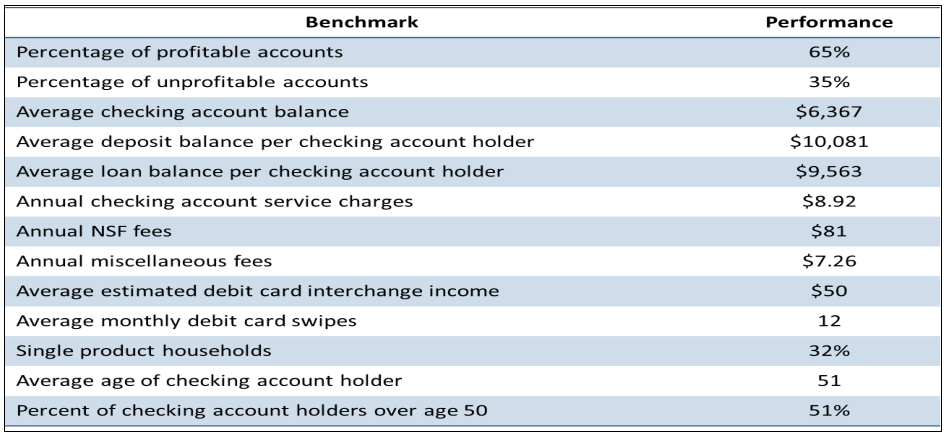

Banks and credit unions can generate “friendly” fees by providing account holders with products and services that address their needs. Sound too easy? Bear with me. For example, aggressively selling checking accounts and then encouraging account holders to activate and swipe their debit cards whenever making purchases can result in upwards of $50 per year in interchange income for the bank or credit union. This is certainly a “friendly” fee that financial institutions can impose simply by promoting the convenience, ease-of-use and security of using their debit cards.

Source: Strategy Corps – 20016 Consumer Checking Financial Performance Report

Source: Strategy Corps – 20016 Consumer Checking Financial Performance Report

No Place Like Home

Financial institutions can also impose “friendly” fees by marketing real estate products such as mortgages and home equity lines of credit (HELOCs). Home purchases and upgrades are the results of lengthy decision-making processes on the part of the consumer. They view closing costs as necessary for the privilege of borrowing large sums of money. Thus, banks and credit unions stand to gain by actively marketing home loan products.

Encouraging the use of debit cards and selling more real estate products can make up for lost revenue from depressed loan demand. Even better, they do so without risking attrition and sacrificing the needs of the account holder.

>>Ready to accelerate acquisitions? Click here to grab the free guide: “7 Types of Household Acquisition Campaigns to Consider.”