More than ever, financial services marketers – as all marketers – are under enormous pressure to deliver highly effective marketing programs and demonstrate a favorable return on marketing investment (ROMI).

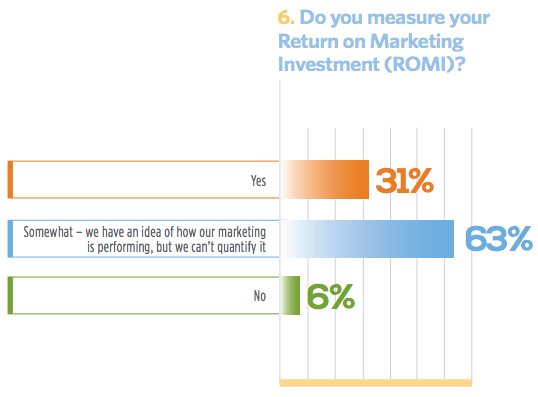

When we asked about measurement in our annual survey, we found that measuring ROMI has reached a near universal adoption rate: 94 percent of financial services marketers are measuring their ROMI, up from 71 percent in 2015.

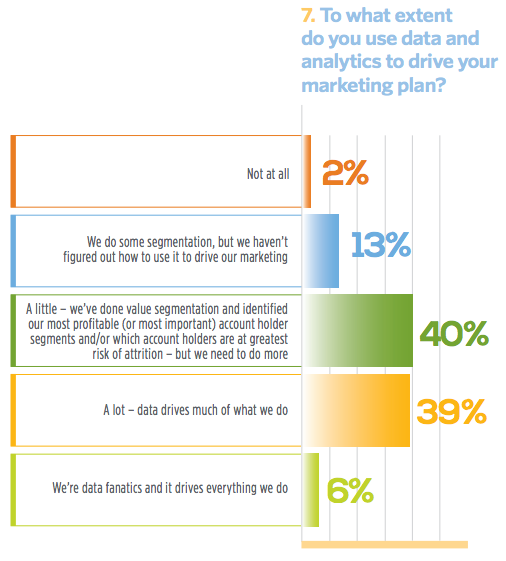

Yet, a majority of respondents are not maximizing their use of data and analytics, despite the fact that 98 percent say they rely on data and metrics to some extent to drive their marketing plans.

Seems the key question for marketers is not whether data and analytics are being used to drive marketing plans, but how and to what extent. And on that score marketers are all over the map. While 13 percent haven’t figured out how to optimize it to drive their marketing spend and activities, 79 percent use it “a little” (40 percent) and only 39 percent use it “a lot.”

Interestingly, the “data fanatics” – who use data to drive everything they do – increased by 50 percent from last year, showing that some of last year’s “a lot” respondents became this year’s “data fanatics.”

Only two percent (the same as last year) don’t use data at all. In 2015, that number was 19 percent.

Measurement has indeed become a must, and accountability in the form of quantifiable evidence is here to stay. That makes data and analytics essential to marketers who have figured out how to use them to drive their strategy and tactics.

Caution: High Expectations Ahead

Proving ROMI has reached the saturation point with financial services marketers. Marketers are using data more and more to demonstrate the effectiveness of their work. Indeed, data and analytics have become essential to prove success. What else did this year’s survey reveal? Read the report to find out.

> Download the full report now